Real Estate Tips: Interest Rate Impact

/Can you believe that mortgage interest rates were once as high as 18.5%!? For a $500K loan at a 30yr. fixed rate, that equates to over $2.286M in interest paid! According to this article written by Yahoo Finance, in the early 1980s, the Federal Reserve was waging a war with inflation. In an effort to tame double-digit inflation, the central bank drove interest rates higher. As a result, mortgage rates topped out at 18.45%.

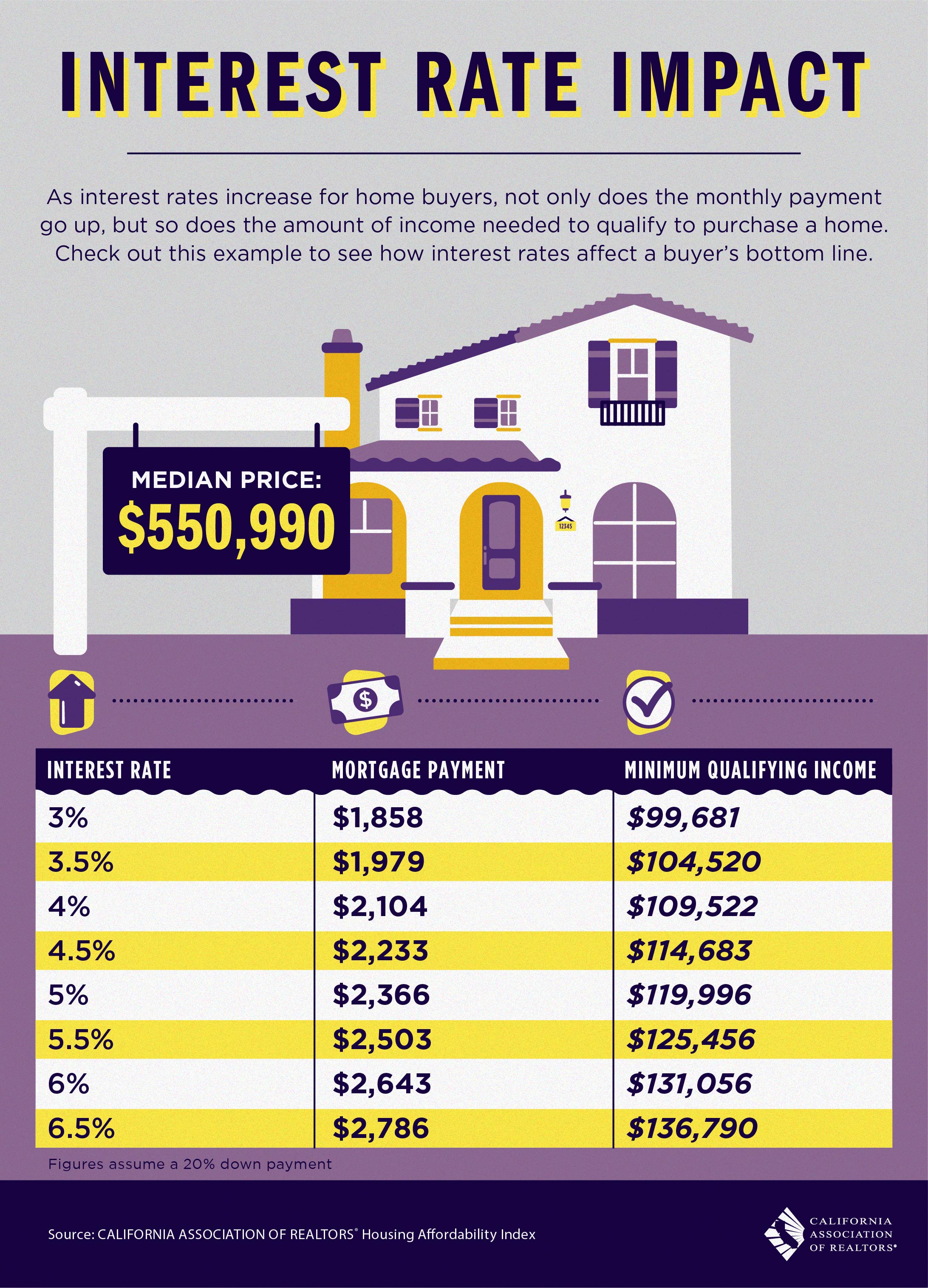

Luckily, in 2018 we are nowhere near interest rates that high, but they are projected to increase based on the market forecast. This can have an impact on not only your monthly payment, but the income requirements in order to qualify for a loan. This is something to factor in if you're in the market to buy, as you need to consider not only the rate at which homes are selling, but if you're financing, the interest rates that will have a considerable impact over the life of your loan. See below a table created by the California Association of Realtors® that outlines the monthly payment and qualifying income requirements as interest rates increase.

Want to understand what type of interest rate you'll qualify for in today's market? Check out my Trusted Advisors page to connect with Greg Parker at HomeServices Lending. You can schedule a time to sit down with him to get a detailed pre-approval note for a mortgage which will include your interest rate.